The bank may cancel any deposits to the Operating Account until the deal closes and is no longer susceptible to chargeback by the Issuer, Account holder, or Affiliates.

Even if an Issuer confirms that the transaction is lawful, the bank may delay payment to a merchant until that merchant has provided sufficient proof of validity to avoid a Chargeback claim. However, the question lies How to get provisional credit, which you will get to know here.

That’s just the beginning. Please keep reading to learn more about provisional credit reversal and what you need to learn about it.

What is a provisional credit?

For an account holder, provisional credits are short-term loans from their bank. Depending on the cause for the credit issue, this statement item may either be reversed or made permanent in the future.

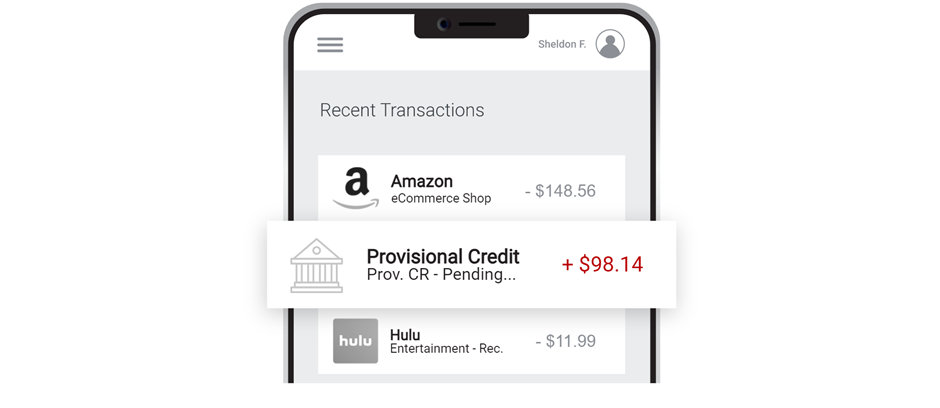

The credit will display a separate line item on the cardholder’s statement. The cardholder’s account will indicate that the transaction was a credit, and it may not go into detail about why.

Contacting the bank to spend provisional credit is typically the best option for cardholders who have questions regarding a temporary credit. You’ll be able to get further information about the credit from your issuing bank, including where it originated from, why it was provided, and when it becomes permanent.

Why do banks issue provisional credit?

Banks may provide cardholders temporary credits pending transaction verification. However, they’re usually given owing to a chargeback.

Sometimes it’s because a transaction hasn’t been validated. If so, the credit would operate as a hold until the deal closes. Usually, banks give temporary credits as an aspect of the chargeback procedure.

Chargebacks are bank-level forced payment reversals. For example, assume a cardholder calls their issuing bank to report an unlawful transaction on their bank statement. The bank then would look into it. If the cardholder seems to be speaking the truth, the bank will credit the card and submit a chargeback on their behalf. The issuer collects fees from the merchant’s acquiring bank to recover the cash.

Here are a few reasons:

This isn’t a complete list. Each card network has hundreds of different reason codes. However, each reason code does have its own set of criteria and requirements for explaining the chargeback.

Impact of provisional credits on merchants

The merchant will eventually have to pay for every provisional credit provided to a cardholder.

As an issuer, a cardholder’s bank (also known as the card issuer) is responsible for providing credit. The issuer must go after the merchant’s bank (the acquirer) to recoup their funds. The acquirer then withdraws their funds from the merchant’s bank account.

It’s not only the transaction amount that a retailer has to worry about. A chargeback fee covers their administrative expenses as a consequence of the chargeback. In addition, the merchants also bear the shipping and logistical costs, resulting in a net loss for them.

There may also be long-term problems. For example, the chargeback rate is affected by every chargeback made against it. This might generate a lot of issues in the long run and perhaps lead to their company’s demise.

Are provisional credits reversible?

Yes. These credits are not final. After all, “provisional” means just that. The business has two alternatives once a cardholder disputes. First, let the chargeback go forward. In this instance, they inevitably lose the disagreement, and the temporary credit is reversed. If the merchant disputes the cardholder’s claim, they might seek a temporary credit reversal or Provisional credit reversal letter. This is done via a process called representation.

The merchant “re-presents” the amount to the financial institution. Of course, presenting the accusation without more information would be futile; it would be denied again. The merchant must also provide persuasive proof that the initial transaction was lawful and should be sustained for representment.

What is Representment?

Representation is the process of providing documentation to the bank to prove that a transaction was legitimate and also that the cardholder’s claim must be reversed. Unfortunately, customers in the modern era have developed ways to create unjustified chargeback claims.

Does representment assure a Provisional Credit Reversal?

To put it simply, “no.” Businesses can recoup money if they think they were wrongly charged back. However, there’s no way to know whether their lawsuit will be successful. Only one in every eight times will merchants revoke temporary credits.

Merchants have an uphill battle. Cardholder satisfaction is essential to issuers. Therefore they do all in their power to ensure it. However, a high level of evidence is necessary to overturn provisional credit reversal. In addition, the acquirer’s chargeback fee is not recoverable even if they ultimately reverse the chargeback.

FAQs

How long does it take a bank to reverse provisional credit?

You should expect your temporary credit to be reversed within five business days after the date of the rejection letter if a Provisional credit dispute is refused.

Can you withdraw provisional credit?

Depending on the inquiry results, a temporary credit may be revoked, withdrawn, or made permanent.

Will a bank issue a provisional credit while investigating fraud?

Whenever a transaction is proven fraudulent under the standard chargeback procedure, the issuing bank instantly credits the customer’s account with a provisional credit.